How to Thrive as a Real Estate Investor in

Rutland, VT

Why Invest in

Rutland, VT

Rutland City is a regional hub for commerce and healthcare, providing consistent job stability and economic growth. The city is home to major employers like Rutland Regional Medical Center and Vermont Electric Power Company, ensuring steady workforce demand. Its vibrant arts community and proximity to outdoor recreation attract both residents and tourists year-round. With affordable property prices and a strong rental market, Rutland offers excellent opportunities for real estate investors.

Real Estate Investment Trends in

Rutland, VT

With a diverse economy, a booming job market, and affordable housing options,

Rutland, VT

provides a solid foundation for long-term growth. Its revitalized downtown, expanding cultural scene, and strong rental demand make it a prime location for both residential and commercial investments. Here’s why

Rutland, VT

is a standout market:

Key Neighborhoods to Watch:

Downtown Rutland: The city’s core features historic buildings, retail hubs, and multi-family properties. Investors can focus on mixed-use spaces to attract both residents and businesses.

East Creek Area: This family-friendly neighborhood offers spacious homes with ample yard space. Investors can target long-term renters looking for stability and proximity to schools.

Killington Avenue Corridor: Known for its rental-friendly properties, this area attracts commuters working in nearby commercial centers. Investors can capitalize on high tenant demand by offering affordable housing solutions.

West Rutland: This growing residential district offers newer developments and improved infrastructure. Investors can target single-family homes with potential for future appreciation.

Forecast and Analysis:

Rutland, VT

Based on the unique characteristics of the

Rutland, VT

real estate market, the following forecasts and analyses emerge:

Rising Home Values:

Rutland’s property market has seen steady price growth in recent years. Investors can capitalize on increasing equity gains through both short-term and long-term investments.

Strong Rental Demand:

The presence of major healthcare facilities and education centers drives consistent rental demand. Investors can target multi-family properties near these hubs for reliable occupancy.

Tourism Boost:

Proximity to Killington Ski Resort attracts seasonal visitors seeking short-term accommodations. Investors can profit by offering furnished vacation rentals during peak seasons.

Steady Economic Growth:

Rutland’s economic stability ensures a solid foundation for property investments. Investors can rely on consistent appreciation and strong cash flow from well-maintained rental units.

Strategies for Conquering

Rutland, VT

To fully leverage the potential of this city's real estate market, consider these unique tactics:

Long-Term Rentals:

Rutland’s family-oriented neighborhoods provide ideal conditions for long-term leases. Investors can target single-family homes near schools and parks for stable tenants.

Multi-Family Units:

Demand for affordable rentals continues to rise in Rutland. Investors can secure steady income by investing in duplexes or triplexes in residential areas.

Short-Term Vacation Rentals:

With tourists visiting Killington Ski Resort and the Green Mountain National Forest, vacation rentals are highly profitable. Investors can maximize revenue by offering well-furnished units near popular destinations.

Fix-and-Flip Opportunities:

Rutland’s older housing stock presents opportunities for value-added improvements. Investors can renovate distressed properties for profitable resale or rental.

Student Housing Investments:

Rutland’s educational institutions create demand for affordable student housing. Investors can target shared accommodations near major bus routes for consistent tenant flow.

Other Opportunities in

Vermont

Apart from

Rutland, VT

, there are other investment opportunities in

Vermont

worth considering:

- Historic District Appeal: Bennington’s colonial architecture attracts buyers seeking unique properties. Investors can enhance property values by modernizing historic homes while maintaining their charm.

- Stable Rental Demand: With healthcare and educational sectors thriving, Bennington offers reliable rental income. Investors can target single-family units to cater to local workforce demand.

- Vibrant Downtown Scene: Burlington’s thriving arts and retail district attracts residents and tourists alike. Investors can secure strong returns by purchasing properties near Church Street Marketplace.

- Waterfront Appeal: Burlington’s scenic views along Lake Champlain create lucrative opportunities for vacation rentals. Investors can capitalize on waterfront properties to attract seasonal visitors.

- Growing Family Market: Essex Junction’s top-rated schools make it an ideal location for family-focused investments. Investors can target three-bedroom homes to meet this rising demand.

- Expanding Workforce: With employers like GlobalFoundries driving job growth, Essex Junction presents stable rental opportunities. Investors can maximize returns by targeting units near major employment centers.

- Expanding Retail Sector: South Burlington’s retail hubs and commercial growth attract working professionals. Investors can focus on rental properties near shopping centers for steady demand.

- Close Proximity to Burlington: South Burlington’s convenient location makes it a desirable spot for commuters. Investors can target multi-family properties for long-term rental income.

Rentastic Verdict

Rutland City, VT, offers attractive investment potential with its combination of affordability, rental stability, and economic growth. Its proximity to Killington Ski Resort and commercial hubs ensures strong demand for both long-term and vacation rentals. Investors seeking affordable entry points with steady appreciation should consider Rutland’s promising real estate market.

Empowering Investors in

Rutland, VT

Rentastic equips real estate investors with powerful tools designed to streamline decision-making and maximize returns in this City's competitive market.

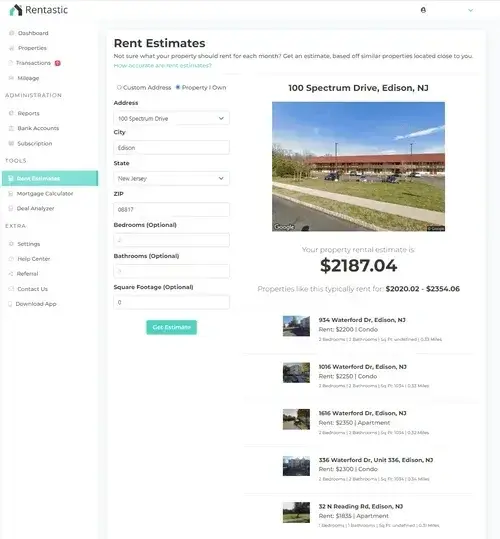

Rent Estimator

The Rent Estimator tool equips investors with valuable insights into the rental market. By analyzing market data and property-specific factors, it accurately estimates the potential rental income of a property. This tool enables investors to set competitive rental rates, project cash flows, and evaluate the profitability of their investments.

Learn More

Deal Analyzer

With the Deal Analyzer tool, investors can perform comprehensive financial analyses of potential real estate deals. By inputting essential financial information such as purchase price, rental income, expenses, and financing details, investors gain a deeper understanding of the investment’s profitability. This tool assists in identifying lucrative opportunities and mitigating risks by providing reliable calculations and insights.

Learn MoreMortgage Calculator

Rentastic’s Mortgage Calculator offers investors the ability to estimate monthly mortgage payments based on loan parameters, interest rates, and loan terms. This tool helps investors evaluate different financing options, determine affordability, and understand the impact of financing on their investment’s cash flow. By making informed decisions about mortgage options, investors can optimize their financial strategies.

Learn More

Expense Tracking

Successful real estate investing requires efficient expense management, and Rentastic’s Expense Tracking tool simplifies this process. It allows investors to track and monitor property-related expenses, such as maintenance, repairs, insurance, and property management fees. By maintaining accurate records and gaining visibility into their expenses, investors can effectively budget, analyze profitability, and make informed financial decisions.

Learn MoreRentastic equips you with all the tools you need to succeed in this City's competitive real estate market. From rental income estimation to financial deal analysis and expense tracking, our platform empowers you to make informed decisions and achieve sustainable investment growth.