Welcome to Rentastic's in-depth exploration of mortgage loans, demystifying the intricacies of this vital aspect of real estate. Whether you're a first-time homebuyer or looking to expand your property portfolio, grasping the fundamentals of how mortgage loans work is crucial. Let's embark on this educational journey with simple language tailored to a 7th-grade comprehension level.

At its core, a mortgage loan is a financial arrangement that helps individuals purchase a home without paying the entire cost upfront. Instead, buyers secure a loan, commonly referred to as a mortgage, from a lender, and gradually repay the borrowed amount over an agreed-upon period.

Let's consider a property valued at $1 million. With a 4% down payment, the buyer pays $40,000 upfront. The remaining $960,000 becomes the loan amount. At a 6% interest rate over a 30-year loan term, the monthly mortgage payment is approximately $5,759.

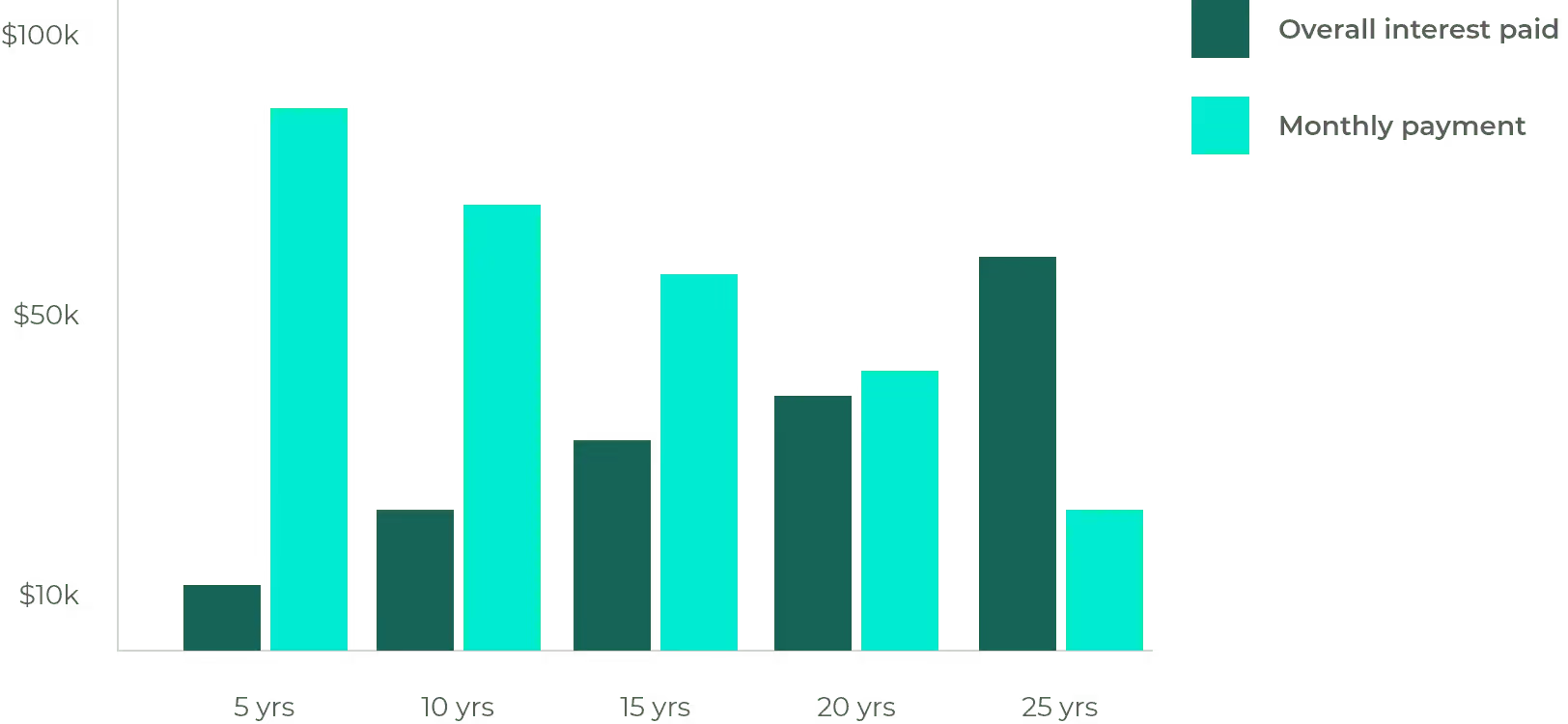

Understanding the impact of loan terms is crucial. Longer terms may result in lower monthly payments but higher overall interest paid. Conversely, shorter terms often mean higher monthly payments but less interest paid over the loan's lifespan.

A larger down payment can lead to lower monthly payments and less interest paid, offering financial benefits in the long run.In conclusion, comprehending the nuances of mortgage loans empowers homebuyers to make informed decisions. At Rentastic, we believe in simplifying the complexities of real estate, ensuring you navigate the world of mortgage loans with confidence. Feel free to explore our other resources and tools to enhance your understanding of real estate financing. Happy homebuying!